“Please, Mom. I want to buy book!”

“Dad, do you have $10?”

“You buy everything for the sisters and nothing for me ever!”

Ugh. Can I just say I get annoyed constantly being asked for money…especially during any sports seasons, when it seems as if there’s a run to the concession stand every other minute? Yet, with this frustration, my husband and I have had opportunities to teach our children about the value of money.

Teaching Our Kids Financial Responsibility

About five years ago, we started giving our kids an allowance. They have a “payday” once a month for completing their daily chores. When we started this, we taught our kids that their money has to be split evenly into three different categories:

- One-third of their allowance must be saved.

- One-third of their allowance must be given to the church.

- One-third of their allowance they can spend.

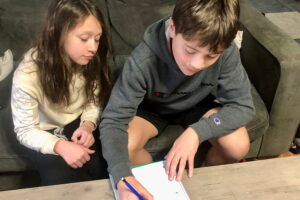

This by no means was (or is still) an easy task. Our three kids are so different, especially when it comes to understanding the importance of the three categories. Our oldest daughter saves every single penny. Our middle daughter spends her allowance before she even receives it. And our son is somewhere in between.

The first few times going to the bank to put money in their savings accounts were very hard. I remember our son having a difficult time understanding how a bank “saves his money”. The teller gave him a small lesson on how a bank keeps his money safe for him until he really needs it. Now, his smile beams from ear to ear when I take him to bank.

I also remember the kids not truly understanding why they had to give their money to the church. This is definitely where I have seen the biggest change in them. At first, we would require our kids to put their money into the church collection. And they just did it because we told them to. However, now they’re asking if they can donate to organizations they care about, or they’ll buy presents to put under the local giving tree around Christmas.

What I’ve Learned from Helping Our Kids Save Money

The single most important thing we can do when we’re teaching our children about the value of money and the importance of saving is to model it. When we’re saving for a vacation or a big purchase, we encourage our kids to be part of the saving process. They’re part of the discussions. I also have to believe our children are beginning to understand how much “things” cost and that not everything is necessarily “needed”.

Trust me, I’m in no way an expert on this topic, and we do spend our money on things that are wants and not needs. However, I believe our children are becoming more responsible with their money and thinking twice about running to the nearest store to spend it.

Shelly Mowinkel

K-12 & Teens

My husband and I have three kids. Our oldest is a freshman in high school, and our youngest is in second grade. Most days, I feel like we are a “tag-team chauffeuring” service, yet I wouldn’t have our life any other way. Not only I am a business/technology teacher at Milford, I am also the district technology integration specialist. I love teaching because I get the opportunity to make those around me better. My hope is that, through my blogging, I am able to inspire, encourage, and share with you my adventures of being a wife, mother, and professional.